MAIA: Credit Spreads Widen Amid AI Concerns and Tech Bond Discounts

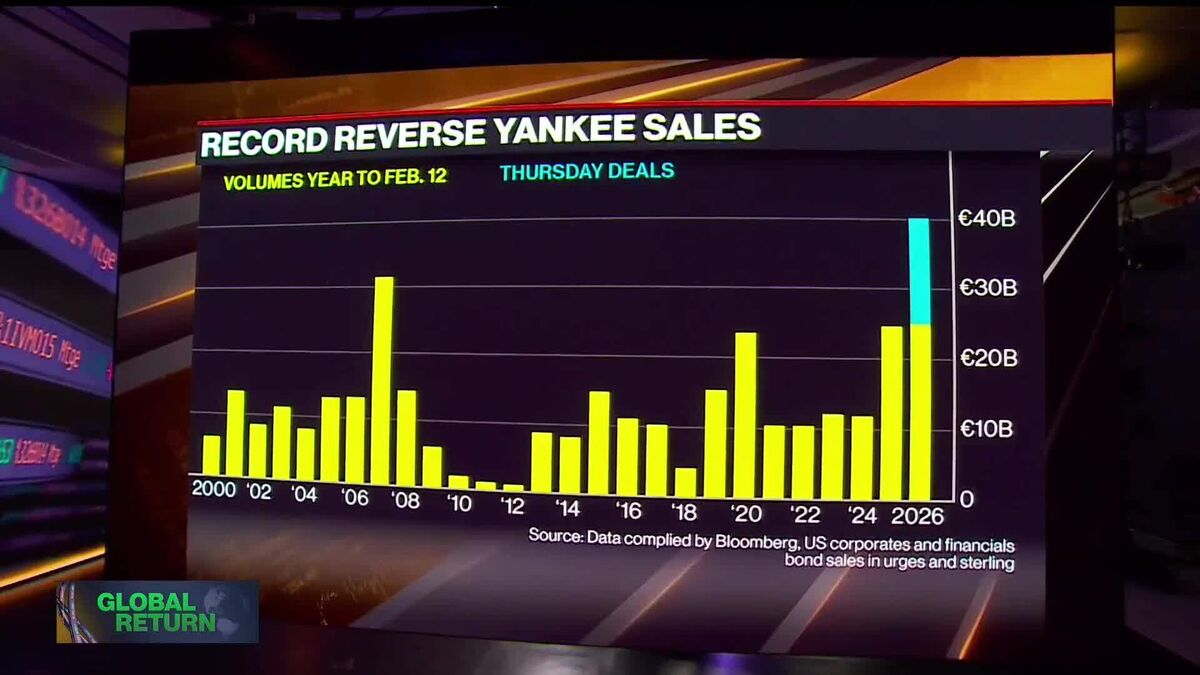

The segment discusses the recent modest widening of credit spreads, driven by both AI-related market fears and a surge in debt issuance. While the overall index shows little change, there is significant dispersion, particularly in leveraged loans and among certain software, insurance, and asset management firms experiencing notable price declines. For the first time since the financial crisis, tech bonds are trading at a discount, attributed to both increased supply and some weakening demand. The guest anticipates continued pressure on corporate spreads throughout the year, noting a structural rise in supply and some balance sheet weakening, though not to a level that threatens company stability.

Original filename: 20260213_215152_Credit_Spreads_Widen_Amid_AI_Concerns_and_Tech_Bond_Discount.mp4 (Source: Bloomberg)