Instacart stock pops 14% on revenue beat, rosy guidance

Advertisement Space - Below Article Title

Advertisement Space - In-Article Ad

Original Source:

Read full article at sourceAdvertisement Space - End of Article

Advertisement Space - Below Article Title

Advertisement Space - In-Article Ad

Original Source:

Read full article at sourceAdvertisement Space - End of Article

Bangladesh Election Result Live Updates: BNP wins 'absolute majority', winning '151 seats'; Tarique Rahman set to be new PM?

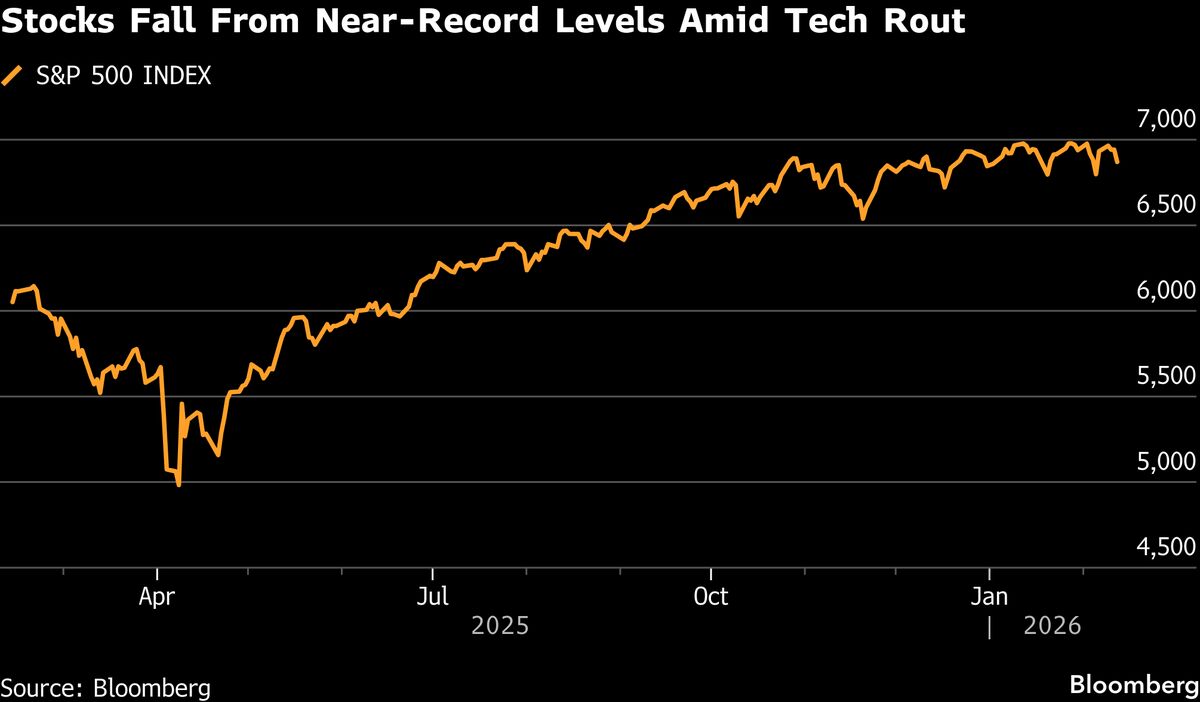

Long-term Treasurys had their best day in months on Thursday, as investors looked for safety in the bond market amid a broad selloff in U.S. equities.

Asian stocks were set to fall Friday after a new wave of AI-linked bearishness hit Wall Street, weakening US tech and Bitcoin, and sending investors to the safety of Treasuries.

Akamai, DoorDash and Alibaba prep for massive earnings moves, while the S&P 500’s failed breakouts signal a darkening technical cloud.

Markets saw continued pressure Thursday as broader AI related fears continued to roil Wall Street. A selloff of shares in US companies perceived to be under threat from artificial intelligence spread across sectors, including more insulated corners of the market like industrials, to send all market gauges lower. Technology names, such as Cisco., AppLovin and Tyler Technologies led the decline. Cisco plunged 12% as investors are concerned hardware and memory-chip prices are weighing on the company’s outlook. Consumer staples and utilities were the top-performing sectors as investors continued to pile into defensive groups. Raphael Thuin, Head of Capital Markets Strategies at Tikehau Capital, joins Bloomberg Businessweek Daily to discuss. He speaks with Carol Massar and Tim Stenovec. (Source: Bloomberg)

Rivian expects to deliver up to 67,000 EVs this year but could dole out more than $2.1 billion on capital expenditures as it expands its roadmap.